Travel and credit cards often go hand-in-hand. Best practices for using credit cards to your advantage when travelling, however, will depend on your personal needs. In most situations, we purchase plane tickets and book accommodation with our credit cards, and pay for meals, shopping and other expenses while at our destinations.

But where ’travel’ and ‘credit cards’ are concerned, the most ideal scenario would have to be funding your travels through credit card rewards programs. Redeeming free or discounted flight tickets, accommodation and travel packages will always be a welcomed treat for cardholders. Many cards also offer exclusive deals through partnerships with hotels, car rental companies, tours; and of course, there’s travel insurance (more on this below).

Choosing the right credit card for your travel needs

There are many details to keep an eye out for when shopping around for a new credit card, with each one boasting their own loyalty programs with unique combinations of travel perks. There are numerous options out there—the right one for you simply depends on your financial priorities and your travel goals.

When narrowing down your shortlist of credit cards, try asking yourself these questions as you take a closer look at each one:

- Is there a sign-up bonus offer?—You can get a big head start on accumulating your rewards points balance by timing it with promo offers meant to entice new cardholders.

- Will the travel rewards you hope to gain offset all the costs, such as annual fees? What about supplementary card fees? Issuing your spouse or family member a card under the same account will speed up rewards collecting. What about foreign transaction fees or unfavourable currency conversion rates when you use the credit card abroad?

- How many points per dollar can you get on everyday purchases such as groceries, gas, dining, entertainment and bills?

- What are the travel perks? For example, free VIP lounge access at airports, comprehensive travel insurance, etc.

- Are you eligible for credit card approval? Cards that offer higher reward returns tend to be more exclusive, reserved for those with higher household incomes and higher credit scores.

The top travel rewards credit cards in Canada

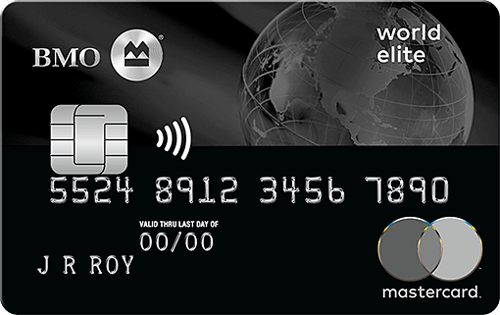

BMO World Elite Mastercard

| Annual fee | $150 (waived on the first year) |

| Supplementary card | $50 each per year |

| Rewards | Earn 3 points for every dollar spent on travel, dining and entertainment; 2 points for everything else |

| Perks | 35,000 bonus points; fly on any airline with no blackout dates; complimentary membership for VIP lounge access; travel insurance |

| Minimum annual income | $80,000 (individual); $150,000 (household) |

Scotiabank Passport Visa Infinite Card

| Annual fee | $139 |

| Supplementary card | Free |

| Rewards | Earn 2 points for every dollar spent on dining, entertainment, groceries; 1 point for everything else |

| Perks | 25,000 bonus points; redeem points for travel with no restrictions; no foreign exchange fees; complimentary membership for airport lounge access; travel insurance |

| Minimum annual income | $60,000 (individuals); $100,000 (household) |

American Express Cobalt Card

| Monthly fee | $10 |

| Supplementary card | Free |

| Rewards | Earn 5 points for every dollar spent on dining, bars, groceries and food delivery; 2 points for travel, transit and gas; 1 point for everything else |

| Perks | Up to 30,000 bonus points; travel, hotel, retail, dining and entertainment rewards; travel insurance |

| Minimum annual income | None (but must be a Canadian resident) |

There are many more Canadian travel credit card choices out there on the market, so a little bit of time and research on comparison sites like Ratehub will certainly pay off!

Are credit card travel rewards worth it?

In the end, the answer depends on your needs as a traveller. Those who travel often, whether for business or pleasure, rack up travel rewards points quickly, by using their credit cards to pay for airfare or hotels. And so, frequent fliers benefit most from these travel-centric cards.

As for the occasional traveller or casual consumer, accumulating rewards points towards air travel might take a little longer, depending on spending habits and lifestyle. It could take a long time to even be eligible for a trip within Canada, never mind an international one—at which point you should reassess whether or not it’s a feasible goal to chase those points!

Think of the benefits to you in the long term and how much value it adds to your life.

Credit card travel insurance: is it enough?

Lastly, your credit card might also offer complimentary perks like travel insurance coverage—emergency medical or accident insurance, trip cancellation or trip interruption, baggage loss or delay, and others—but the question isn’t what they offer, but do they offer enough coverage for your travel needs?

There are often key restrictions to the policy, particularly when it comes to the length of travel or the maximum amount of coverage you’re eligible for. Other considerations should be made as well, such as coverage for family members accompanying you on your trip or any pre-existing health conditions you might have.

One easily overlooked term is that you might need to book your trip with your credit card to be covered by that card’s travel insurance policy. It’s always best to check with your card company first, and if you’re still unsure about it, check out this quick guide to help you decide if your credit card travel insurance coverage is really all you’ll need.

Enjoy your travel rewards!

Justin